Asia-Pacific Superyacht Market trends continue at a remarkable pace, cementing the region’s growing role in the global maritime industry. The Asia-Pacific Superyacht Report 2025 – recently published by Superyacht Times – gives deep insight into the Asia-Pacific Superyacht Market.

In an independent review of this report, ICOMIA and its Superyacht Working Group spotlight some key takeaways. To read the full report, head to Superyacht Times’ website via the links in this post.

Click on the heading below to jump to your chosen paragraph –

Key Trends in the Asia-Pacific Superyacht Market

Based on the latest research, here are the ten key takeaways from the Asia-Pacific Superyacht Report 2025:

1. Superyacht Activity Booming in Asia-Pacific

The number of active superyachts over 30 metres in the Asia-Pacific region has grown significantly:

- 530 superyachts were active in 2024

- Up from 445 in 2023

- This represents a 19% year-over-year growth

This sustained growth reflects increasing interest in the region as both a cruising destination and a base for superyacht operations.

2. Asia-Pacific Yachts Are Bigger Than the Global Average

The region is seeing a preference for larger vessels:

- 20% of the Asia-Pacific fleet is over 50 metres

- Globally, this figure stands at 16%

This trend underlines the maturity of the market and the growing demand for high-volume, high-value assets.

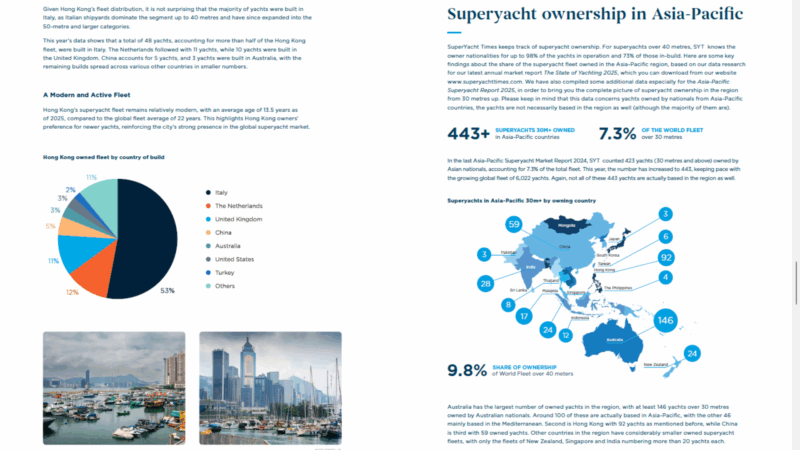

3. Australia and Hong Kong Lead Superyacht Ownership

Ownership remains concentrated in key locations:

- Australia accounts for 146 yachts

- Hong Kong follows with 92 yachts, 75 of which are based locally

This concentration supports a robust local market, further reinforced by the supporting infrastructure in both countries.

4. Used Yacht Market Remains Tight

Inventory in the used superyacht market remains constrained:

- Only 19% of superyachts are for sale in 2025

- This marks a continued trend of low availability, despite increased demand

Limited supply puts upward pressure on asset values and suggests a seller’s market.

5. Asia-Pacific Is a Rising Force in Yacht Building

The region has become a notable player in global yacht construction:

- 538 yachts over 30 metres were built in the Asia-Pacific

- This accounts for 8.9% of the global fleet

Taiwan leads regional production, with additional activity in China, Australia, and New Zealand.

Supporting Industry Indicators

6. Refit Visits Surge

Demand for refit facilities continues to rise:

- 2,100 refit shipyard visits recorded in 2024

- Up from 1,500 in the previous survey period (2019–2021)

This suggests growing operational activity and the importance of maintenance infrastructure in the region.

7. Expansion Fuelled by Fleet Growth

Fleet growth is driving significant expansion across the region:

- Growth in megayacht activity is the key driver

- Resulting in expanded services, berthing facilities, and supporting industries

8. Construction Activity Stays Strong

Superyacht building activity remains robust:

- 691 new superyachts over 30 metres were under construction in 2024

- This reflects ongoing industry confidence and investment

9. Record Completions in 2024

The number of newly completed yachts reached historic levels:

- 228 new completions, the highest since 2008

- This peak underlines current manufacturing capacity and demand

10. 2025 Pipeline Heavily Booked

Looking forward:

- 316 yachts over 30 metres are expected to be delivered in 2025

- Strong backlogs point to sustained market health

Conclusion: A Thriving Market with Global Impact

As demand for superyachts continues its upward trajectory, the Asia-Pacific region is clearly emerging as a key player in the global yachting landscape. With increasing ownership, a trend toward larger vessels, and robust construction activity, the region offers both opportunity and momentum for stakeholders. Continued investment, infrastructure development, and market interest suggest that Asia-Pacific will remain a strategic focal point for the superyacht industry in the years ahead.